On August 13th, a carefully planned release turned into a shock launch, when an anonymous user managed to deploy the CRV token contract without warning.

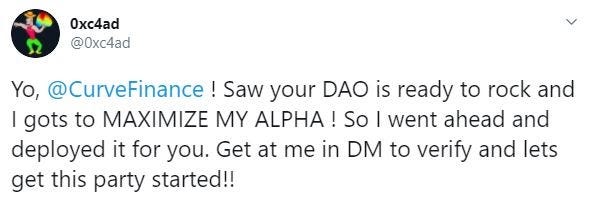

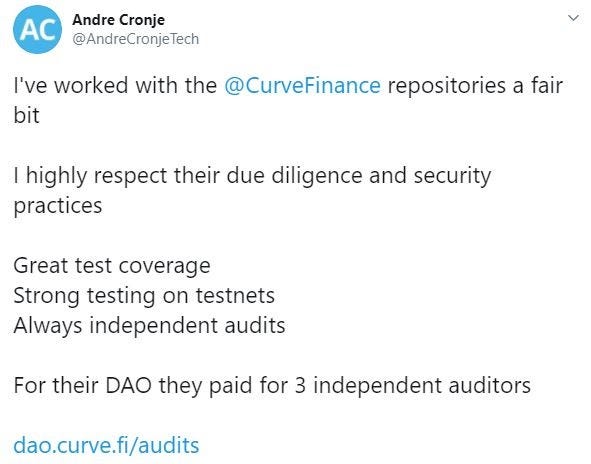

Expecting a scam, Curve admins were surprised to see the deployed contract was identical to the original.

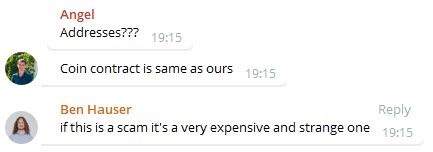

A user by the name of 0xc4ad had paid 19.9 ETH to deploy the contract by pulling the code from Curve’s GitHub.

The following tweet from the anonymous account was published at 18:25 UTC on the 13th August.

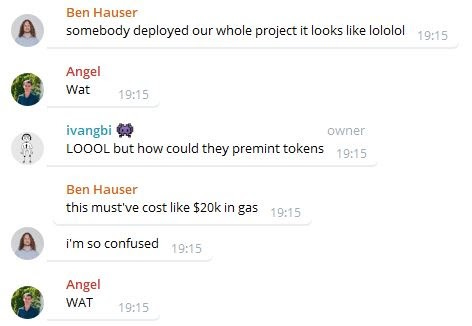

Many Curve users, admins included, expected this to be a scam, and there was a period of intense confusion as everyone tried to figure out what was happening.

However instead of immediately disregarding and invalidating the release, Curve stated that they were auditing the information, whilst warning users not to interact with the contract.

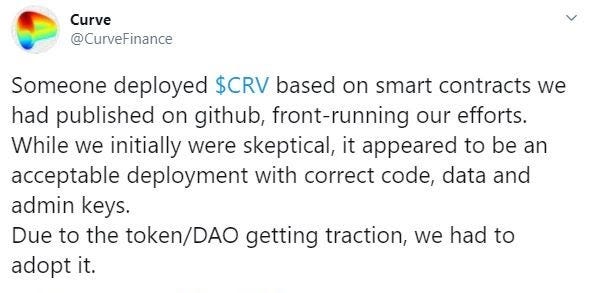

This was followed by a reply to the anonymous dev:

During a period of frantic uncertainty within the Curve Telegram and Discord groups, some users decided to interact with the unofficial protocol directly.

Any feelings of suspicion about the contract quickly turned into shock, as Curve decided to legitimise the contract on Twitter.

The token is now live, and although it wasn’t deployed by Curve, the code is identical to what they were intending to deploy themselves.

This story is comparable to Satoshi’s launch of Bitcoin, a truly decentralised, anonymous, and permissionless action.

This token release caused Curve’s TVL to increase to over $1 billion in a matter of days.

It’s clear that large centralised exchanges had been keeping a close eye on Curve, as Poloniex announced trading pairs for CRV only seven minutes after the official launch.

They were quickly followed by Binance and Huobi, who seem keen to profit on the huge demand for trading of DeFi tokens.

However, DEXs have outperformed CEX growth by 5X in the past month [1]), and most of the trading volume so far (+$21 million) has taken place on decentralised exchanges such as Uniswap & Mooniswap.

The token price hit an all time high around three hours after launch, when it traded for $54 on some CEX, and much higher on DEX.

The following chart from Dune Analytics shows the changes in trading volume and daily APY% since the 9th of August when the pre-release tokens ceased issue, up to the 15th of August as we entered the new stage of earning CRV via staking yCRV.

Curve.fi have played an important role in the DeFi gold rush, since the release of the COMP token in June 2020, they have been right in the centre of the action, selling the shovels.

The high liquidity and low slippage available on Curve.fi allows for huge savings when swapping stablecoins; a key tool for the yield farmer.

They provide one solution that fixes several problems: more deposits into Curve means larger coin swaps can be done with no slippage, less deposits into Curve means higher APY for liquidity providers, and the basic feature of swapping stable coins is incredibly useful for arbitrageurs.

There will be several theories on what happened during this launch period and who was behind the 0xc4ad account; many people are of the opinion that this launch should have been invalidated and that the whole affair reflects negatively on the Curve DAO team.

However, at Stake Capital, we are of the opinion that Curve Finance chose to do what was best for their users when forced into a difficult and unexpected situation.

The growing popularity of Curve is well deserved, and will not be slowed by this unusual turn of events.

Curve has captured more than 20% of all DEX volume in the past few months; decentralised governance votes are just around the corner, and their close working relationship with yEarn.finance suggests many more innovative and profitable tools will be coming from the Curve / yEarn family.

Stake Capital congratulates Curve on their unique yet successful launch, and we look forward to seeing what’s next…

by @an0nynoir