Curve Tokenomics and First-Mover Advantage

Is the network effect creating a liquidity "black hole"?

Curve.fi continues to absorb liquidity at a rapid rate; the dramatic release of the CRV token caused a huge increase in TVL, and they have a clear first mover advantage within their field.

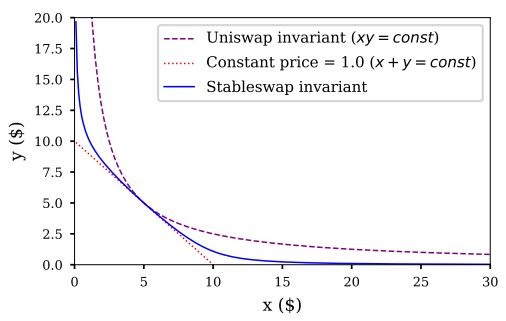

Initially Curve had a huge technological advantage; the slippage/liquidity ratio was far better than anything else in its narrow market niche. This was enough to overtake Uniswap, who was their sole competitor at that time, despite Curve having less liquidity to begin with.

The following graph is from the Curve (then called Stableswap) whitepaper. You can see Curve is able to provide a much more favourable slippage/liquidity ratio than Uniswap.

However, is this head start enough for them to maintain their leading position, and how loyal are their users?

Although being a first-mover is not a guarantee of success, it is a powerful advantage once it triggers the “network effect”, where each additional user increases the value of the product.

For a newcomer to take users away from Curve, they would have to offer a similarly large advantage, i.e x100 to x1000 better than Curve.

However, as more and more users join Curve, it becomes less likely that they would leave. They each add value to the network, in this case by adding more liquidity, which means less slippage for those who use Curve to swap between stablecoins.

As Curve becomes more efficient and is able to transact larger amounts with less slippage, both users and liquidity providers will benefit from this virtuous cycle.

The product that tries to beat Curve will be handicapped by not having this first-mover advantage, and could therefore struggle to build a user-base, resulting in very little network effect.

Artist’s representation of early Curve LPs draining the liquidity from Uniswap

Tokenomics

Curve DAO currently has more users than YFI, MTA, YFII or UMA[2]. The tokenomics of Curve mean their users have a vested interest in regularly interacting with the protocol.

Locking CRV increases the amount of influence a holder can have on the governance process, and also allows for up to 2.5X CRV boost on their supplied liquidity.

This dynamic of locking CRV is not just paying people to vote, but it also serves to keep users within the Curve ecosystem, as they continually lock in their CRV tokens to boost their rewards.

As liquidity providers gain more rewards and become more financially invested in Curve, they will likely become more personally invested in the outcome of the governance votes, and take on more responsibility for the well-being of the platform.

Everyone wants to make profit: Curve manages to leverage this fact and create a way that it can be achieved together - an aligned economic interest which requires care and thought to maintain.

The CRV token is a token by and for LPs and users of Curve. It wasn’t made for speculation, or external investors who don’t use the protocol. Its current use is within a closed system for Curve liquidity providers, that rewards long-term holders and users of the CRV token.

At the time of writing, there is $1.11 billion locked into Curve[3]. Owning CRV gives the holder a say in how that money is managed.

Aside from the obvious benefits of boosting yield, holding large amounts of CRV grants the holder power when it comes to governance.

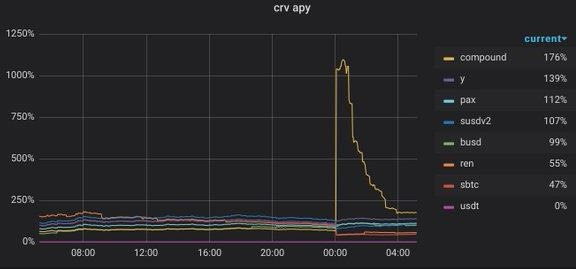

The above graph shows the impact on APY% of the Curve Compound Pool when a vote was passed to increase its gauge weight (higher weight = earn more CRV). This resulted in a huge influx of liquidity which brought its APY back down quickly, however this move was likely to be fairly profitable for those who triggered the vote.

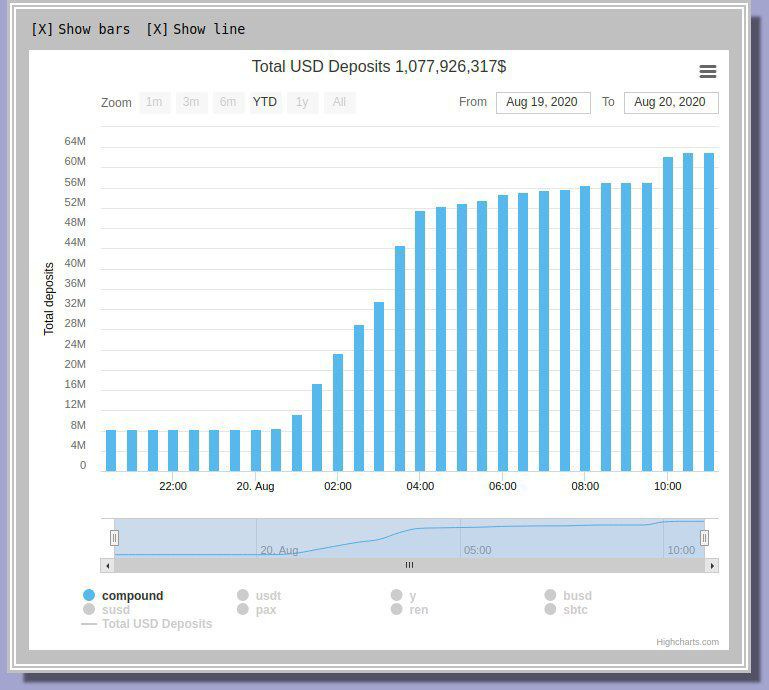

Below you can see the huge increase in deposits as users chased the boosted yield of the compound pool.

So we can see clearly there is profit to be made from having influence on vote outcomes.

This ability to influence voting so strongly will add to the demand for CRV, as some participants will want to change how APY is distributed, and may push a vote in their favour if they hold enough CRV.

CRV is not just money, it’s power.

Currently, many users are dumping CRV as soon as they farm it, however this narrative is likely to change once people realise the utility of the token.

The utility of the CRV token will only increase as the Curve developers continue to bring out new features, and with future votes likely to cover important topics such as insurance and expanding on new markets, most liquidity providers will choose to vote rather than sell.

For example, CRV holders may vote to add an “admin fee” on top of the current 0.04% fee charged. This admin fee would be distributed among CRV holders. As the TVL and total volume continues to grow, this could result in even more profit for CRV holders.

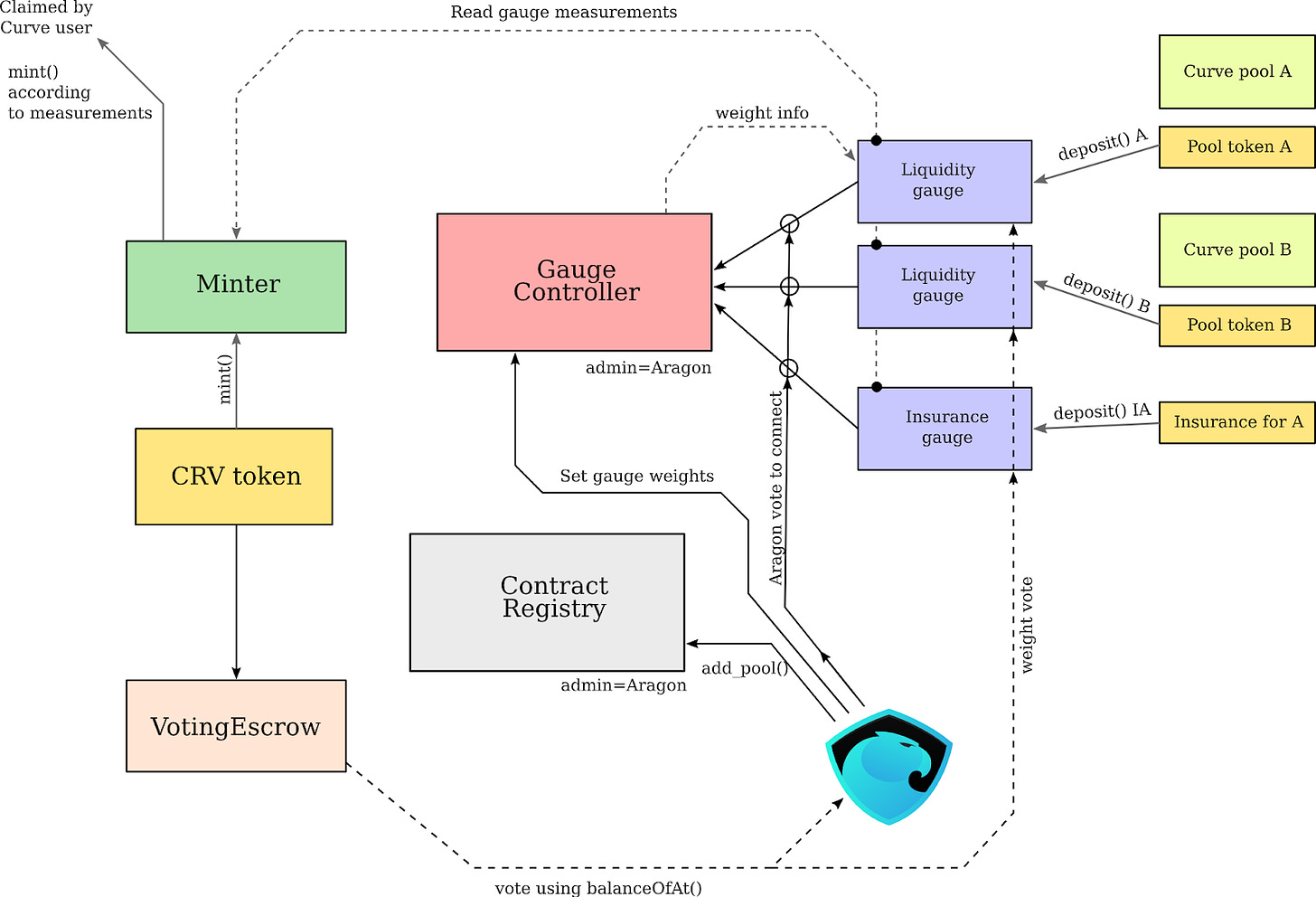

This diagram shows the Curve tokenomics at work; you can see how LP and CRV interact and move throughout the system.

Provide Liquidity to Curve Pool

Receive Liquidity Provider Tokens

Deposit Liquidity Provider Tokens into Curve DAO Gauge

Receive CRV

Lock CRV to boost earning %

Vote on Governance and take control of how your money is managed.

This is an incredibly powerful system that will continue to grow and provide value to users.

The CRV token caused Curve TVL to rise from $280 million to $1 billion in 3 days, and as the Curve system continues to go from strength to strength, they are creating a liquidity blackhole that could prove impossible to beat.

by @an0nynoir